4.4 billion people live in cities and that number is growing by 1.5 million each week.

90% of the urban growth will occur in developing and emerging economies.

Cities currently generate around 80% of the world’s economy and there are close links between levels of urbanisation and per capita GDP.

Rapid urbanisation is fueling cities’ infrastructure needs. Yet a US$15 trillion global investment gap, to realize this infrastructure by 2040, currently exists.

There is limited interface between infrastructure project promoters in low- and middle-income countries and investors.

Significant global private capital is available to invest in bankable infrastructure projects, especially those supporting the UN SDGs.

There is an ongoing challenge that prospective projects tend to be insufficiently prepared for investment and therefore remain unfinanced.

Introduction To The

Cities Investment Facility

The Cities Investment Facility (CIF) is an innovative, multi-stakeholder initiative centered around unlocking private investment in sustainable urban infrastructure projects in low- and middle-income markets. While there is significant investor demand for bankable, construction-ready projects, these markets have traditionally struggled with the project preparation processes that foster investment readiness. This has resulted in an annual global infrastructure investment gap of US$15 trillion by 2040, with the vast majority of that in low- and middle-income countries. It is the Cities Investment Facility’s goal to significantly reduce this gap.

This goal is achieved by supporting project promoters with:

- Marketing of their projects to a global audience of construction-finance providers and/or long-term operations investors;

- Advice regarding the project preparation processes of ideation, feasibility, development, and financial closure; and

- Pre-construction funding (as both grant and private capital) for these processes, with the ultimate goal of securing construction/long-term financing from other external lenders and investors.

The Cities Investment Facility aims to significantly increase the amount of private capital for infrastructure projects (within UN-Habitat’s existing geographical footprint) that are aligned with both the UN Sustainable Development Goals (SDGs) as well as city development plans. We see this as crucial to boosting sustainable development and addressing rapid urbanization which fuels the growing global annual infrastructure financing gap.

Cities Investment Facility Components

A series of three components work to engage city authorities, project promoters, investors, and other stakeholders in the CIF. Each is facilitated by a number of contributors to the programme, which together comprise the CIF’s Implementing Partners.

The CI Portal is an online platform that hosts and tracks the progress of the sustainable urban infrastructure projects that have been admitted into the CIF, as they make their way through project preparation towards bankable, construction-ready status. It is the first entry point into the programme, comprising a digital platform that enables cities to better promote their urban development projects to an audience of construction/long-term investors and third-party experts who can provide financial and technical advisory support.

Learn MoreThe CI Advisory Platform is primarily responsible for supporting projects that are in the earlier stages of preparation, providing technical assistance enabled by the donor-funded CIF Feasibility Fund. Project promoters receive assistance with early-stage technical and financial de-risking activities, with many associated external costs (e.g., feasibility studies conducted by a consultant) provided for by the Feasibility Fund. Additionally, the CI Advisory Platform is also responsible for assessing, verifying, and certifying project SDG impact using UN-Habitat's proprietary SDG Project Assessment Tool.

Learn MoreThe CI Vehicles provide private-capital finance and further bankability guidance to projects that have reached the mid-stage of preparation, in order to drive projects to financial close with other, third-party construction/long-term lenders and investors. They are often those that have been prepared and de-risked to mid-stage with the assistance of the programme’s CI Advisory Platform, and now require the typically more significant investment needed to complete project preparation to a bankable, construction-ready status. Part of this process includes assisting project promoters in identifying and securing the appropriate equity sponsors and lending institutions.

Learn More

Feasibility Fund

The CIF is seeking to establish a Feasibility Fund valued at US$20 million by the end of 2025 through philanthropic donations and grants, which will be utilized to support the CIAP component. The CIAP will be the primary beneficiary of the Feasibility Fund, with the average spend per project estimated at US$700,000. In addition to supporting project preparation activities by the CIAP, the Feasibility Fund will also support earmarked and non-earmarked expenses including those related to the CIP's management, capacity building with local governments, and other related administration expenses by CIF.

Find out moreHow To Apply

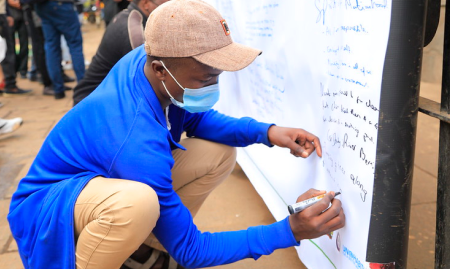

The CIF invites you to submit your urban infrastructure development projects to join the CIF pipeline. The application process is currently closed. Please register your details here to be notified as soon as the application process is open. You can review the process and project questionnaire in advance.

How To Apply