Bringing CIF to a global audience: WUF11

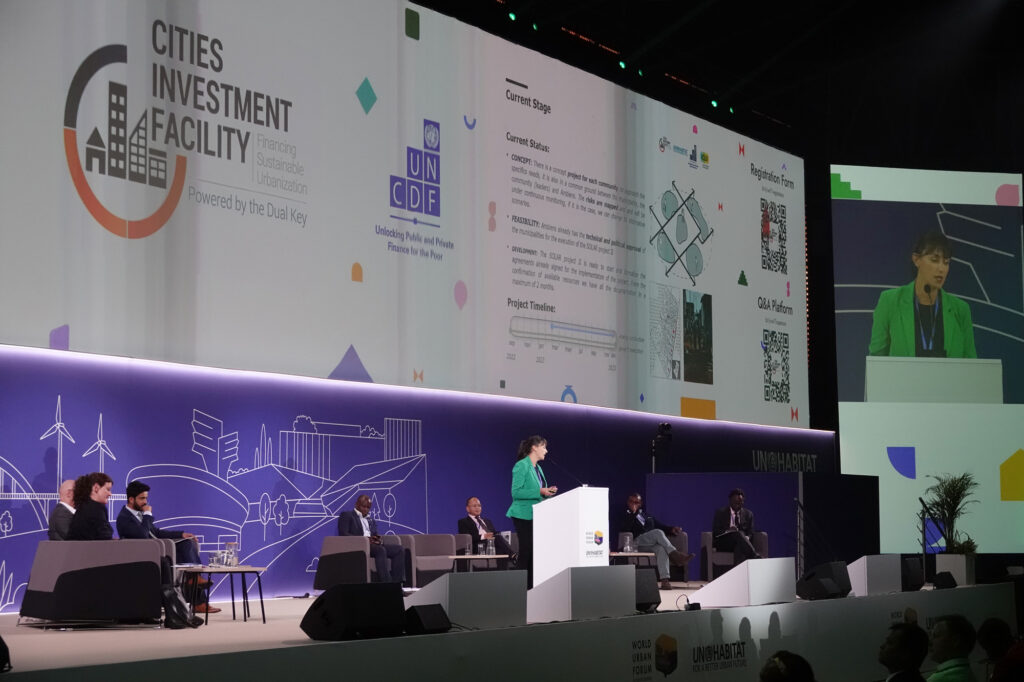

To bridge the municipal infrastructure funding gap and catalyze progress on the achievement of the 2030 Action Agenda, the Cities Investment Facility convened ICLEI, UNCDF and UN-Habitat, organizations with vast expertise in developing climate projects at the local level, for the deployment of a Cities Investment Fair and Project Showcase at the Eleventh Session of the World Urban Forum (WUF11) in Katowice, Poland.

The Cities Investment Fair facilitated knowledge sharing among cities and enabled participating local governments to present their priority climate infrastructure projects to an eminent panel of project preparation facilities who offered their feedback and suggestions to the city-leaders. Further conversations were held between panel members, city-leaders pitching projects and the audience.

The Project Showcase brought together investors, donors, project preparation facilities and local governments by presenting case studies of SDG-aligned projects and demonstrating how the Cities Investment Facility have helped them to incorporate sustainable strategies, to increase the alignment of projects with the Sustainable Development Goals, and to improve the feasibility and bankability of their projects for investment. It also included an interactive panel discussion around “Sustainable Urban Development through Private Financing with Blended Finance Strategies”, featuring the main Implementing Partners of the Cities Investment Facility to highlight their role and expertise.

These events were complemented by the participation of the Cities Investment Facility and its Implementing Partners at the WUF11 Exhibition Area. The 21 square meter Exhibition Booth was located next to the Urban Cinema and the Association of Polish Cities, being shared by all Cities Investment Facility Implementing Partners to demonstrate the “CIF in Action”. Several CIF activities were displayed to (i) highlight areas of collaboration between the Cities Investment Facility and its Implementing Partners; and (ii) showcase sample projects supported by the Cities Investment Facility around the world.

Since the Cities Investment Facility is establishing a donor supported evergreen fund to support the early project preparation work performed by its Advisory Platform Implementing Partners, a Feasibility Fund Dinner was also organised, in the margins of WUF11. It introduced prospective donors (philanthropic institutions, foundations and other technical assistance funders) to the Cities Investment Facility programme and its various Implementing Partners and discuss how the Feasibility Fund is critical to support the de-risking of early project preparation work.

Summary of the Discussions

The discussion at the Cities Investment Facility Sessions highlighted the critical need for effective actions to bridge the municipal infrastructure funding gap and to generate public and private financing that is aligned with the SDGs, in the framework of strengthen project preparation processes to increase bankability and lower the costs of investment.

Bridging this gap requires a two-pronged approach. The first is to build effective, accountable, revenue and public financial management systems, within local and regional governments, so that revenue can be optimized. and expenditure channeled in a way that leaves no-one behind. A robust local financial system is also key to attracting external investment. The second is to channel finance from multiple sources to cities. This involves empowering the local financing system, as well as directing external sources of finance to cities, through excellent project preparation and investor outreach.

Speakers stressed that local governments need to be supported to fully leverage the financing options available to them to fund necessary public investments and create trust to attract private investments. The need to de-risk investments and build trust between the different actors involved, with close attention to context-specific solutions, was also highlighted as crucial. To do so, speakers at the session noted the need to ensure that projects create value across multiple stakeholders and the role of the Cities Investment Facility in helping local governments reframe and co-create different ways to structure the projects, e.g., carbon credits, land value capture, increase of property value. In this framework, speakers highlighted the importance of exploring co-benefit opportunities to bring other stakeholders on board, in order to reduce involvement risks. This is also related to the need to build local capacity in administration on how to do project management in a better way that engages stakeholders.

The importance of investing in subnational finance by government partners, the private sector and donors was also stressed, as SDG implementation happens at the local level. In this regard, the expansion of the local fiscal space by intergovernmental fiscal transfers was suggested. Addressing this issue, in conjunction with coordinating between different government levels, improving the policy and regulation environment, supporting cities to have access to international capital markets and make conditions favorable to these cities; and solving the issues of data available for planning, budgeting, and ensuring correct targeting, was highlighted as key to adapt the available financial systems for being fit for purpose.

The conclusions emanating from the panel discussions and the presentations of the speakers were contrasted with the pitch sessions of the selected projects. Project promoters had the opportunity to discuss each of the elements previously described in the framework of the implementation of their project, with suggestions from the panel to catalyse the required funding and support in a context-specific framework.